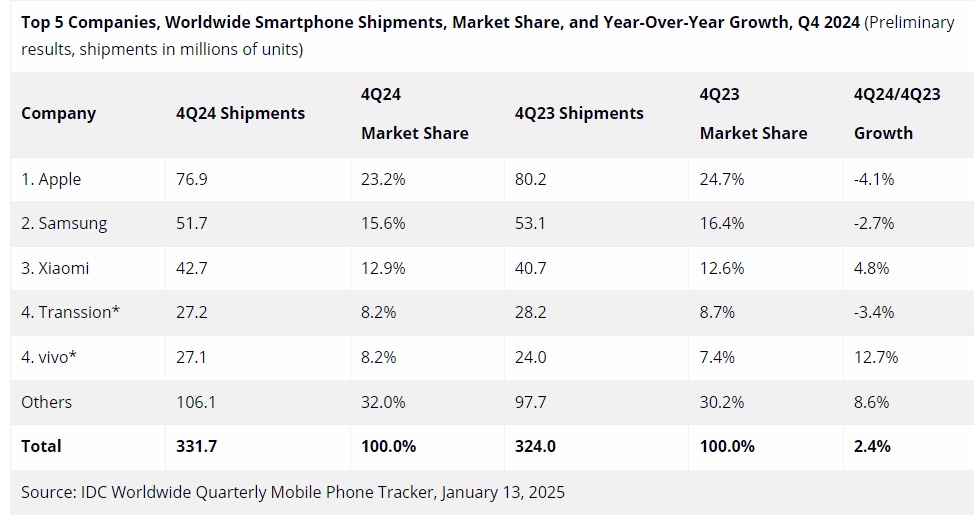

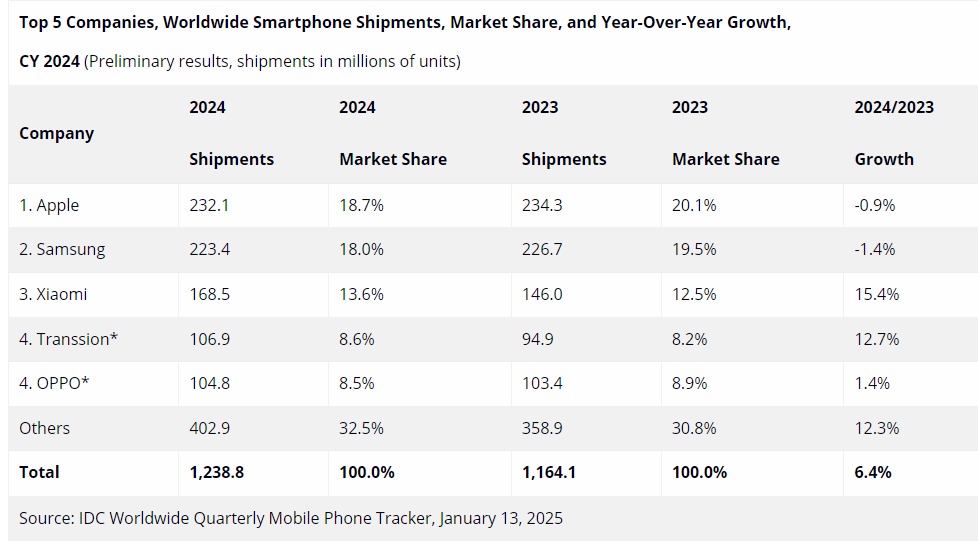

International Data Corporation (IDC) has released its latest Worldwide Smartphone Market Tracker, reporting that smartphone shipments increased 2.4% year-over-year (YoY) to 331.7 million units in 4Q24. In 2024, the market saw a 6.4% growth and 1.24 billion shipments, marking a strong recovery after two challenging years of decline.

Apple and Samsung remained the top two players in Q4, with market shares of 23.2% and 15.6%, respectively, and for the whole year, with total shipments of 232.1 million and 223.4 million units, respectively. Both leaders experienced a YoY decline due to the aggressive growth of Chinese vendors this year, according to IDC.

Xiaomi secured the 3rd position for the quarter with a 12.9% market share, and for the year, its total shipments reached 168.5 million units. It achieved the highest YoY growth rate of 15.4% among the top 5 players.

Transsion, which includes itel, Infinix, and Tecno, held the 4th position in both Q4 and the entire year, achieving a growth rate of 12.7%. However, it tied with vivo for the 4Q24 and with OPPO for the year.

Analysts attribute the growth of smartphone shipments in 2024 to brands’ strategic moves, including promotions, launching devices in multiple price segments, interest-free financing plans, and offering aggressive trade-ins. Another factor is the remarkable growth of Chinese vendors, who achieved a historic milestone with the highest combined shipment volume ever recorded in a single quarter.

Foldables shipments continue to face challenges as consumer demand decreases despite aggressive promotions. Hence, companies have reported shifting R&D focus on implementing AI features on smartphones, which should continue to drive growth in 2025 as well.

Commenting on the growth of Chinese vendors in 4Q24, Francisco Jeronimo, vice president for EMEA Client Devices, IDC said,

This past quarter was particularly remarkable for the largest Chinese smartphone vendors: Xiaomi, Oppo, Vivo, Honor, Huawei, Lenovo, realme, Transsion, TCL, and ZTE. They achieved a historic milestone as they shipped the highest combined volume ever in a quarter, representing 56% of the global smartphone shipments in Q4.

While their core markets remain China and Asia, these brands are rapidly expanding their footprint throughout Europe and Africa, driven by the strong performance of their low-end and mid-range devices. Notably, Huawei stands apart, with most of its shipments in the high-end and premium segments, underscoring its distinct market positioning in China.

Commenting on the worldwide smartphone shipment, Nabila Popal, senior research director for Worldwide Client Devices, IDC said,

The strong growth witnessed in 2024 proves the resilience of the smartphone market as it occurred despite lingering macro challenges, forex concerns in emerging markets, ongoing inflation, and lukewarm demand.

Vendors successfully adjusted their strategies to drive growth by focusing on promotions, launching devices in multiple price segments, interest-free financing plans, and aggressive trade-ins—fueling premiumization and boosting low-end devices—especially in China and emerging markets. While we remain optimistic about continued growth in 2025, the threat of new and increased tariffs from the new US administration has elevated uncertainty across the industry, driving some players to seek preventative measures to mitigate risks; however, thus far, the impact has been minimal.